Quantopian – Technology to Backtest and Execute Algorithmic Trading

Algorithmic trading is growing field in finance that uses computers to execute securities trades. With growing research in artificial intelligence and machine learning, a computer’s ability to interact with markets and other human phenomena has rapidly increased. The financial sector is becoming increasingly reliant on computers for finding transactions, making markets, and executing trades, and at the heart of algorithmic trading are simply computers following their programming to make buy/sell orders for certain securities. For awhile though, algorithmic trading was a field pertaining only to experienced data scientists, programmers, and mathematicians that worked on Wall Street banks and Chicago prop shops. Yet, with the development of tools such as Quantopian and QuantConnect, any trader can connect his or her brokerage account to an algorithmic platform and execute computerized transactions.

Quantopian

Quantopian is a fascinating company founded in Boston under the mission of “bringing Wall Street to main street.” Beneath its bright red exterior on the homepage is a service that offers testing grounds for trading algorithms, algorithm design competitions, full-fledged brokerage connection services to trade real money, and a crowd-sourced hedge fund. The last feature, a crowd-sourced hedge fund, is a curious dynamic offered by Quantopian.

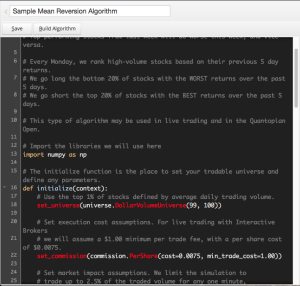

Quantopian holds competitions between its users to write stock trading algorithms. Whoever has the most successful algorithms is then invited to manage $100,000 of Quantopian funds and keep all of the profits made on that money. Given that it’s free to register for Quantopian, anyone interested in having their stock market strategies see large-scale use (or at least, larger than individual investing) should learn the Quantopian trading API (which is in Python) and compete in their monthly contests.

In all, I highly recommend investigating Quantopian’s services if you are interested in learning how algorithmic trading works or testing your own strategies. The 35,000+ Quantopian community provides support for all levels of experience, from seasoned investors without knowledge of Python to college programmers looking to get into the finance industry.

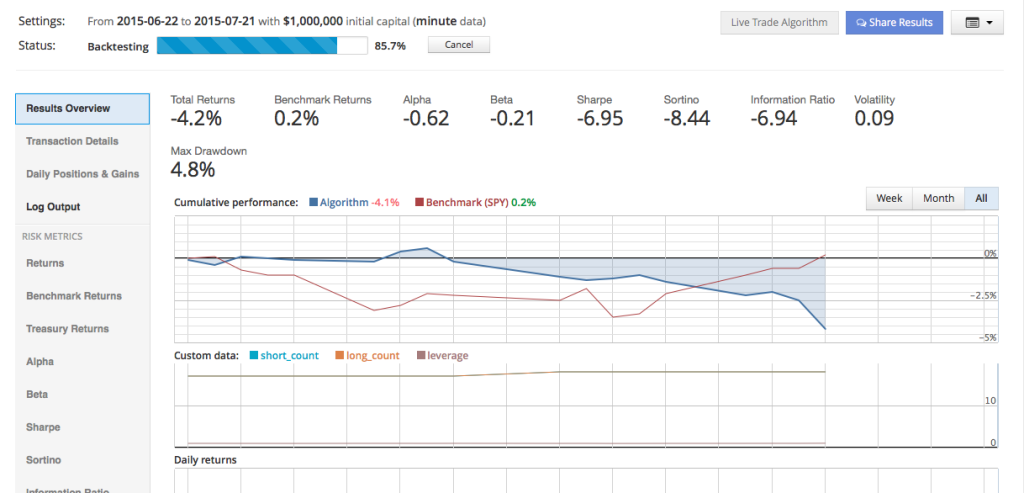

Sample backtesting interface

Leave a Comment