Top finance apps for your iPhone that help you keep tabs on your budget and expense

You may find keeping track of both your budget and your expenses a very intimidating task that may wear you out. This may lead you to find trivial excuses to do without this aspect in your daily life. However, you need to realize that if you are a working individual and plan to make purchases, whether small or heavy ones, you will need to adopt a systematic approach that will help you keep a detailed account of where you end up spending your money and draw up an accurate budget that will help curtail unwarranted expenses. This holds especially true in cases of debt relief. However, manual calculations and accounting can be a daunting task and therefore, if you are the owner of an iPhone, you have a plethora of apps at your disposal that can help you in your financial endeavors by keeping a tab on your expenses and budgeting. These apps are especially beneficial when you wish to manage your personal finances.

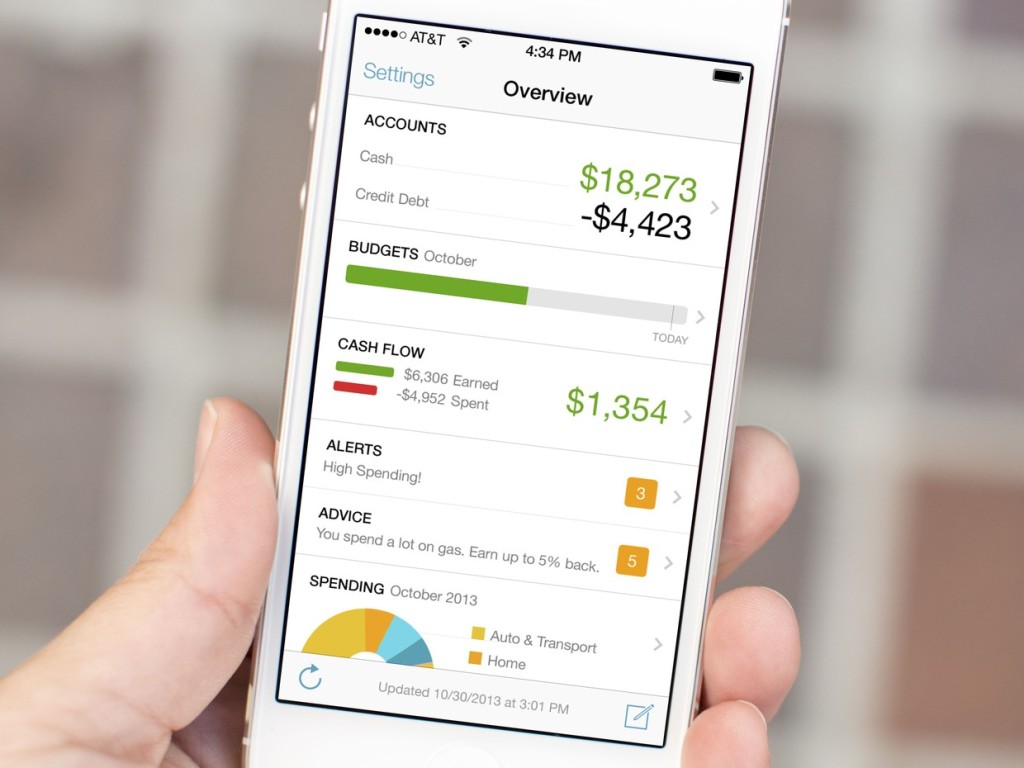

Mint:

This can easily be considered as one of the most popular apps in the App Store and there is a plethora of people who rely on this app to keep their personal finances straight. Every financial account that you hold are trying to keep a track on can be controlled effectively in one app alone. You have the option of having your bank and credit card account linked to the app. This can be beneficial in several ways as the app helps you stay more organized by providing a comprehensive list of your incomes and expenses. One of the best features that Mint possesses is its ability to keep you organized and stand true to the budget that you may have drawn. It constantly guards your accounts held in banks and credit card companies so that it can keep notifying you if you happen to near your limit for the budget set. This app can be increasingly helpful especially if you are going through the phase of debt relief.

-

BUDGT:

What makes BUDGT unique when compared to the app mentioned above is the simple fact that you are not compelled to offer any kind of personal information to this app. In fact, it is also completely alright if you wish to skip the step of providing login information. BUDGT, as the name suggests, is an extremely straightforward and easy to use app wherein using the app is as simple as entering the amount, the budget for which you would like prepared and keep feeding the app with information pertaining to your incomes and expenses and you are good to go. However, the fact that BUDGT does not take into account the detailed information on banking and credit card statements makes it less user friendly to people who are in a financial crisis. Therefore, this app works best if you already have your finances sorted.

-

Spendee:

This app has only been launched pretty recently but has managed to create headlines with its incredibly easy to use interface. Usually, with other apps, it takes a good amount of effort to keep a record of your daily incomes and expenses. However, this is not the case with Spendee. It is quick and completely hassle-free. The main feed of the app is known for displaying the latest financial entries that you have made. This ensures that you double check whether all the entries made are appropriate. You get access to a detailed analysis of your spending activities so that you can take corrective steps, if any.

Lamar Thomas is a financial analyst and a social media geek. He loves to read extensively on financial topics and also has a background in financial education. He also has experience in the debt relief section of finance.

Leave a Comment